Back taxes can grow into a severe financial burden if left unresolved. In fact, Americans failed to pay $688 billion in taxes on their 2021 returns alone. More recently, the IRS stepped up its pursuit of high-income earners and partnerships, collecting over $1 billion by mid-2024.

Due to the Inflation Reduction Act, the IRS has secured additional staffing and resources to push harder on collection—and this means that we can expect even more audits in future. However, there’s no need to worry. There are usually simple answers to any question. The key to managing back taxes usually lies in how people manage the resolution process.

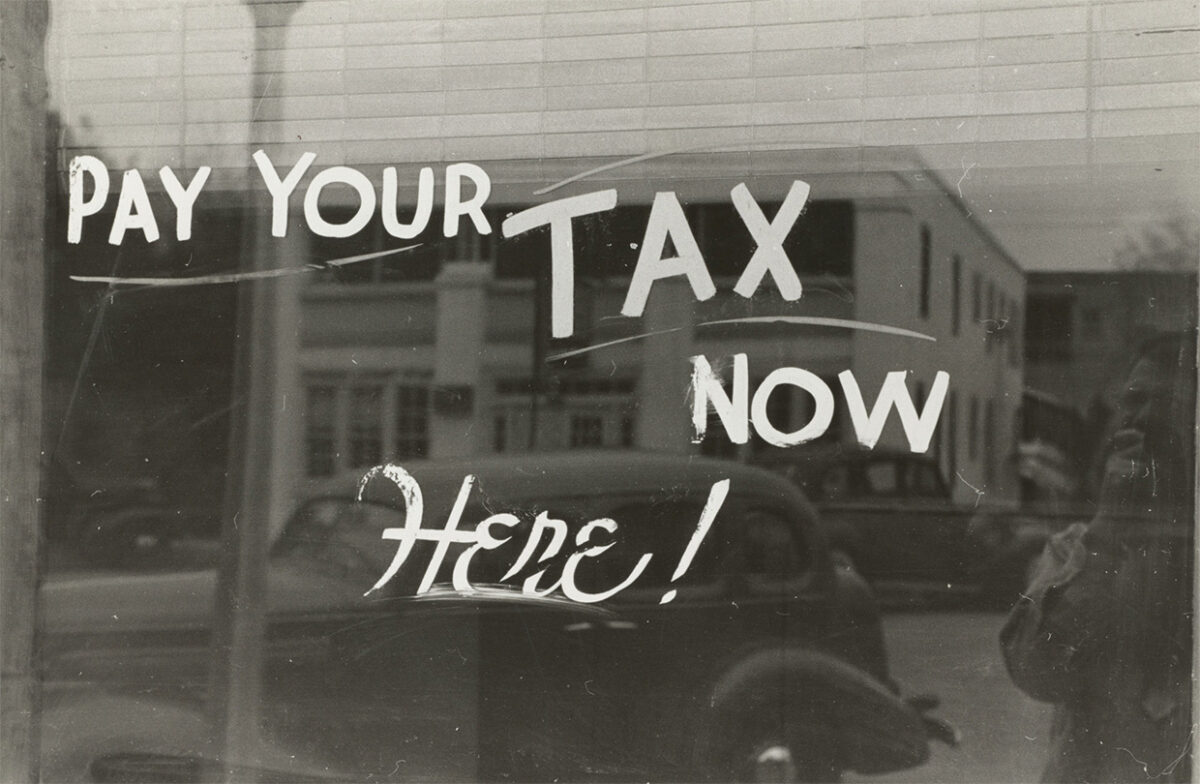

In this blog, we outline essential steps to help you simply address these taxes, as well as provide actionable tips for avoiding penalties in the future.

Understanding Back Taxes and Their Consequences

Back taxes refer to any unpaid tax liability from a previous year. The repercussions of unresolved tax debts can escalate quickly, ranging from accumulating interest to IRS penalties or even wage garnishments. In 2024, the failure-to-file penalty increased to $450 or 100% of unpaid taxes, whichever is less.

Interest on back taxes compounds daily, further burdening taxpayers who delay action.

Failure to address back taxes also affects your creditworthiness. For example, liens placed by the IRS may appear on credit reports, diminishing scores and hampering loan approvals. Addressing back taxes promptly not only prevents these repercussions but also minimizes financial strain.

The IRS also has various systems to identify non-filers and tax underpayments. Automated reporting through W-2s and 1099 forms means discrepancies between reported income and filed returns are quickly flagged. In 2024, the IRS targeted 125,000 high-wealth taxpayers who were said not to have filed taxes since 2017.

The bureau looks certain to stick to this approach in coming years, but they’ve reassured small businesses and households earning $400,000 or less that they won’t see a ramp-up in audit rates.

Still, this recent change is a good reminder of the importance of accuracy and vigilance when preparing tax returns, even for past years. Finally, taxpayers should be aware that the IRS may extend the statute of limitations on audits beyond three years if fraud or significant errors are suspected. This further emphasizes the urgency of resolving outstanding debts.

Steps to Resolve Back Taxes

To resolve back taxes, proactive measures are crucial. Start by determining the exact amount owed by consulting IRS transcripts or notices. Setting up a payment plan can ease financial strain. According to the IRS, 67% of taxpayers on installment agreements successfully settled their debts within two years in 2023.

Options such as partial payment agreements or Offers in Compromise (OIC) allow qualifying taxpayers to settle for less than the total owed, providing additional relief.

Don’t be afraid of communicating with the IRS! If you contact the bureau before deadlines, they may show leniency. If your personal finances are strained, demonstrating reasonable cause—such as medical emergencies or natural disasters—can result in waived penalties. Many taxpayers look to professionals like David’s Family CPA to identify deductions or credits.

For those with minimal financial resources, an offer in compromise (which used to be known as Fresh Start Program) may provide additional flexibility. This initiative allows taxpayers to avoid liens or have them removed after entering into installment agreements.

Preventing Future Tax Penalties

Avoiding penalties starts with consistent, informed tax practices. Filing taxes on time, even if actual payment isn’t possible, can avert late-filing penalties. For instance, a 5% monthly penalty is reduced to 0.5% if taxpayers file timely and arrange payments later. Furthermore, ensuring accurate paycheck withholding helps meet annual tax obligations without surprises.

Estimated taxes are essential for self-employed individuals, especially now that the IRS has more than doubled the underpayment penalty from 3% to 8% (partly because of rising interest rates). Online tools, like the IRS Tax Withholding Estimator, can assist in calculating amounts, helping you to reduce the risk of underpayment.

It’s worth taking the time to learn about deductions, including home office expenses and health savings account contributions, as well as keeping up-to-date on tax code changes.

One often overlooked strategy to reduce penalties involves filing an extension. While extensions grant more time to file, they don’t delay payment deadlines, so paying at least 90% of the estimated tax liability by April 15 can prevent additional charges.

David’s Family CPA suggests that you maintain comprehensive records of income and deductions throughout the year, as it really helps to simplify tax preparation. Taxpayers who make use of digital services often report that they experience fewer filing errors—and that brings us neatly to the next point.

Making Use of Technology and Professional Resources

Modern tools simplify tax management. Apps like QuickBooks and TurboTax integrate real-time income tracking and deduction calculators. Similarly, professional services like David’s Family CPA can provide tailored strategies for tax optimization, often uncovering savings unavailable through DIY filing.

Specialized software platforms also provide audit protection services. Programs like TaxAudit offer audit defense for a nominal annual fee, giving taxpayers peace of mind when dealing with more intricate tax scenarios.

Seek professional help for more intricate returns, especially those involving multiple income sources, investments, or inheritance. Remember that tax attorneys are experienced in negotiating directly with the IRS, ensuring compliance while pursuing the most favorable outcomes.

Building Long-Term Tax Resilience

It’s a good idea to set aside emergency funds for unforeseen liabilities. Retirement contributions also offer dual benefits, as they reduce taxable income while preparing for the future. Investments in 401(k) or IRA plans not only save for retirement but also decrease immediate tax burdens.

Another effective method for enhancing resilience is through diversified income streams. Side businesses, rental properties, or investments can provide additional funds to address unexpected tax liabilities. However, managing these requires attention to quarterly estimated taxes and recordkeeping to avoid surprises.

For taxpayers with recurring issues, participating in IRS educational programs or tax workshops can help to address knowledge gaps. If you have any doubts, please get in touch with David’s Family CPA, as we are happy to provide you with more personalized support.